Despite all the obligations and speculations, blockchain technology continues to sustain itself in this competitive world. In the same way, tokenization has been developing globally since blockchain appeared. The real estate industry is one of the major transformations driven by technological advancements through asset tokenization. Being one of the most innovative technologies, real estate tokenization uses blockchain to represent the ownership of physical assets with digital tokens.

Most of the people in and around the world are associated with the real estate market, whether as owners, employers, or buyers. Having a sturdy understanding of this process is important for those who wish to enter this innovative field. So, if you truly wish to grasp the principles, then look through the following real estate tokenization guide to learn its core principles, framework, real-time access, and technologies.

What is Real Estate Tokenization?

The rise of tokenizing real estate has changed the way people trade in real estate businesses. In a blockchain, the method of converting a real property into a digital token is called real estate tokenization. Each token in this process represents a fraction of a real estate property, which enables investors to buy, sell, and trade shares of the property at low cost with greater efficiency.

Subsequently, this process of representing the digital tokens as real estate assets increases liquidity and fractional ownership. However, processing these tokens on a blockchain platform provides a secure and transparent ledger and reduces the need for intermediaries. This allows a wide range of investors to get involved in tokenization, making it trustworthy.

How Tokenization Applies to Real Estate

Here, the main function of tokenization in real estate is to divide an asset into digital tokens, each representing a portion of the overall ownership. This method of tokenization allows a wider range of investors to purchase a part of the property without needing to purchase the entire asset.

Say, for example, consider any property worth $1 million that is tokenized into 10,000 tokens, and each represents a value of $100. Now, any investor can purchase these tokens by gaining equal rights and a share in the property’s revenue.

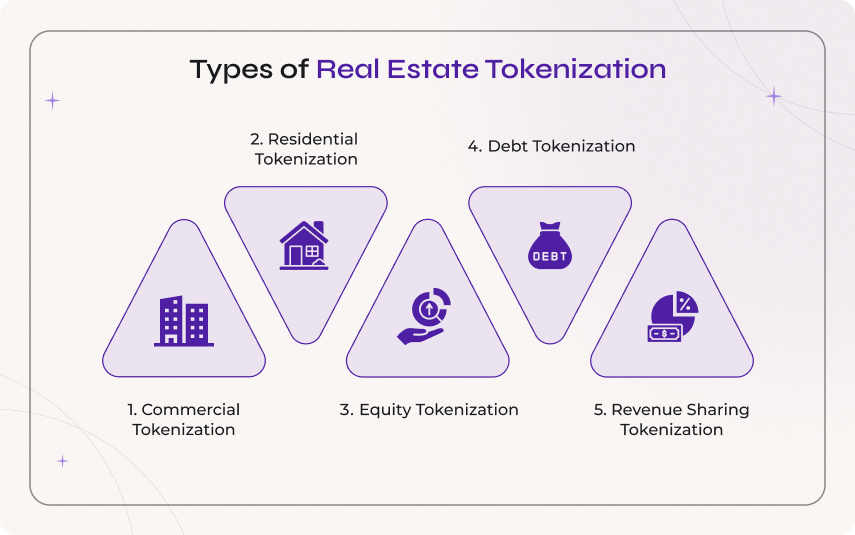

Types of Real Estate Tokenization

Commercial Tokenization

In the real estate sector, he conversion of actual assets into digital tokens is called commercial real estate tokenization. This includes business properties such as retail centers, office buildings, industrial properties, or mixed-use developments. In essence, tokenizing commercial real estate can modify the traditional real estate property and make it more liquid, transparent, and accessible via blockchain technology.

Residential Tokenization

Like commercial real estate, residential tokenization represents the conversion of individual residential properties, such as houses and apartments, into digital tokens on a blockchain. This breaks down the property into smaller and tradable units, allowing a wide range of investors to access the real estate investment easily with fractional ownership shares.

Equity Tokenization

Equity tokenization involves tokenizing the ownership of a company or any investment fund in a real estate-related business. This allows the particular investors to gain a share of the company’s profit and capital gains from the holdings. Moreover, this equity tokenization is similar to investing in shares of a real estate investment trust (REIT).

Debt Tokenization

The transformation of real estate debt instruments, such as loans or mortgages, into a digital representation of a token via a blockchain platform is called debt tokenization. These tokens describe a small portion of a real estate loan, where the token holder receives fixed interest payments.

Revenue Sharing Tokenization

Revenue-sharing real estate tokenization is a type where investors share the income generated by real estate assets, including retail space revenue, hospitality income, and more, through a digital token. In simple terms, it denotes dividing a property’s value into digital tokens on a blockchain. Investors buy these tokens to get access to a percentage of the property’s revenue.

Get started with custom real estate tokenization development. Book your free session now!

How Real Estate Tokenization Works

Any investor who is unclear about the framework of tokenizing real estate, can go through the detailed working process below.

Step 1: Asset Selection

The initial step in the tokenization process is to find a real estate asset, be it a residential property, commercial building, etc. Here, the owner needs to carefully examine the specifics like the location of the asset, its value, and its popularity of the market.

Step 2: Legal Structuring

Once the asset is selected, the property is typically placed into a legal structure like an LLC to check its legal structure. This investigation of the asset helps to examine the property’s legal as well as financial details to lower the risks in the tokenization process.

Step 3: Creation of a Token

Now, you need to get the best blockchain platform, like Ethereum or Polygon, to create digital tokens that represent the fractional ownership of the legal property. Say, for example, if you own 100,000 tokens, you own a share of 10% of the particular property or entity.

Step 4: Token Distribution

The next step is to distribute the tokenized property on the market or any platform to make it available for the investors. Here, investors can pay using cryptocurrencies or fiat currencies and purchase the tokens as per their requirements.

Step 5: Administration and Trading

As a last step, the property is managed according to the terms and conditions set out. Now, the investors can keep their tokens to earn income from the rent or sell them on secondary markets.

Benefits of Tokenizing Real Estate Property

With its various benefits and applications, tokenization allows a group of investors to directly invest in the real estate sector. Here are some of the noticeable features that every investor must consider before tokenizing their real estate property.

- Liquidity: Liquidity is one of the most outstanding benefits of real estate tokenization. It allows investors to easily buy and sell fractional ownership of the property, with faster transactions and accessibility.

- High Transparency: Every transaction in the blockchain real estate tokenization is recorded immutably with high transparency. This allows investors to view and verify their transactions at any time without data manipulation.

- Fractional Ownership: Real estate tokenization becomes handy and finds a suitable buyer for high-value assets. This act breaks down the barrier and helps numerous individuals to contribute to the property’s ownership.

- Global Access: Tokenized real estate via a blockchain can be traded globally by paving the way for investors to access and purchase the market anywhere without cross-border limitations.

- Reduced Transaction Cost: With the blockchain technology, the intermediaries such as brokers, notaries, and legal advisors can be eliminated, which leads to low transaction fees and fast processing time. Moreover, the automated smart contracts approve transactions automatically and minimize human error in this field.

- Enhanced Security: In real estate tokenization, the ownership recordings are done securely, which reduces the risk of fraud and improves auditability, thus enhancing the trust between investors and buyers.

- Regulatory Compliance: Tokenized real estate often undergoes the security regulations and legal provisions such as anti-money laundering (AML) and Know-Your-Customer (KYC), ensuring investor protection.

Use Cases & Real World Examples

Industries Using Real Estate Tokenization

- Farmland and Agricultural

The real estate tokenization platform in farmland and agriculture can lead to various unique technologies using blockchain technology. This works similarly to traditional real estate tokenization and stands as an advantage for buyers from both farming and land value.

- Real Estate Investment Trusts (REITs)

The real estate investment trusts allow investors to invest in real estate for the long term through property ownership. Moreover, REITs allow individuals to invest in large-scale real estate properties without the need for owning or managing the properties.

- Infrastructure Projects

The infrastructure projects in real estate tokenization are represented in the form of digital tokens, which enable fractional ownership and ease of trading. However, these may include properties such as a power plant, a building, or a portion of a highway.

- Hospitality Real Estate

Tokenization allows smaller investors to own a small part of hospitality sectors like resorts, hotels, etc. In essence, this allows investors to purchase a token and get a share of the original property.

- Commercial Real Estate

Tokenizing major assets like shopping malls, office buildings, and warehouses comes under commercial real estate tokenization. Moreover, the tokens that are tokenized under the commercial real estate can be purchased, sold, and traded on the blockchain platforms, which will speed up the money of commercial property owners.

Examples of Real Estate Tokenization

- Lofty AI: Lofty AI allows users to invest in fractions of rental properties across America. It is a marketplace especially for tokenized rental properties. Here, users can buy and sell ownership in the form of digital tokens.

- MERCADO Bitcoin: Mercado Bitcoin, a leading platform in Brazil, uses real estate tokenization to offer new investment opportunities. It enables fractional ownership and makes the property shares easy to trade.

- RedSwan: RedSwan in the U.S. is a premium trade center for tokenized commercial real estate. It gives assurance to investors to invest in the real estate market in a highly secure, straightforward, and transparent way.

- St. Regis Aspen Resort: This resort in the USA tokenizes properties using Aspen Digital, which is an asset-backed coin. This turns the ownership into digital tokens by allowing investors to get a share in the luxury hotel.

- Manhattan Condo: The Manhattan Condo property in New York is the first asset to get tokenized on the blockchain platform (Ethereum). This transformation increases liquidity and accessibility, making investors and real estate investments more representative.

Future of Real Estate Tokenization

Currently, the real estate tokenization platform is transforming the property investment landscape by offering increased accessibility, liquidity, and fractional ownership. Its integration with smart contracts will enhance more sophisticated and customizable investments by improving its transparency.

Despite its technological challenges and hurdles, real estate tokenization remains one of the most promising applications of blockchain in the real world. While the market is still evolving quickly, it is expected that real estate will grow significantly and will reach trillions of dollars by 2030.

Conclusion

The outlook of the real estate tokenization platform is superior and is widely used by most people, whether a businessperson or an investor. Say thanks to blockchain, as it has brought a decentralized and equitable financial system to the real estate sector with increased liquidity. Moreover, tokenization has been a truly amazing factor for the real estate sector, and it supports a wide variety of investors and developers to access and participate in investing in real estate. If you are one among them, you can utilize the above real estate tokenization guide to go through its types and frameworks.

Additionally, you can even opt for professionals from our experts or get connected with BlockchainX, one of the top real estate development companies, to gain more knowledge. Without any delays, get in touch with us and start planning your new venture.